Appraisal in NCSS

NCSS contains an array of tools for appraisal and mass appraisal analysis, including Comparables Appraisal, Appraisal Ratio Studies, and Hybrid Appraisal Models, as well as tools for regression and descriptive summaries. Each procedure is easy-to-use and validated for accuracy. Use the links below to jump to a specific appraisal topic. To see how these tools can benefit you, we recommend you download and install the free trial of NCSS. Jump to:- Introduction

- Technical Details

- Comparables Appraisal

- Hybrid Appraisal Models

- Appraisal Ratio Studies

- Multiple Regression for Appraisal

- Other NCSS Procedures Useful in Mass Appraisal

Introduction

Mass appraisal is the process of using standardized procedures and statistical testing to value large numbers of properties for a given date. We at NCSS have sought to provide tools for mass appraisal based on the recommendations of industry experts, as well as important articles and texts in the field.Technical Details

This page provides a general overview of the capabilities that are available in NCSS for mass appraisal. If you would like to examine the formulas and technical details relating to a specific NCSS procedure, click on the corresponding '[Documentation PDF]' link under each heading to load the complete procedure documentation. There you will find formulas, references, discussions, and examples or tutorials describing the procedure in detail.Comparables Appraisal

[Documentation PDF]Appraisers often estimate the market value (current estimated sales price) of a subject property from a group of comparable properties that have recently sold. Since sales data are considered the best evidence of market value, this is the preferred approach to market value estimation when sales data are available. Without the sale of the property itself, it is widely considered that the best estimate of market value of a property is the recent sale price of highly similar properties in close proximity to the subject property. This procedure is used to estimate the market value of a subject property from comparable properties based on the sales comparison approach. The Comparables Appraisal procedure in NCSS contains tools and reports for all steps of the sales comparison approach. First, it allows you to select an appropriate subset of your sales database, such as properties in the same area of similar age, size, and sale date. Then the comparability (or distance) of each of the candidate subset properties to the subject property is measured based on specified attributes. The investigator may then select specific properties as comparables, or use those that are most similar to the subject property. Next, the comparable property sales prices are adjusted to the subject property based on specified amounts or percentages, for each unit of difference from the subject property. Finally, an average or weighted average of the adjusted sale prices of the comparable properties can be used to estimate the subject property market value. The sales comparison approach to property value estimation has five steps: 1. Select a pool of candidate properties from a database of recent sales. 2. Rank these properties according to similarity to the subject property. 3. Select the desired comparable properties. 4. Adjust the comparable property values according to differences in attributes from the subject property. 5. Estimate the subject market value based on the average of the adjusted values of the comparables. The Comparables Appraisal chapter of the NCSS documentation contains many details about each of these steps.

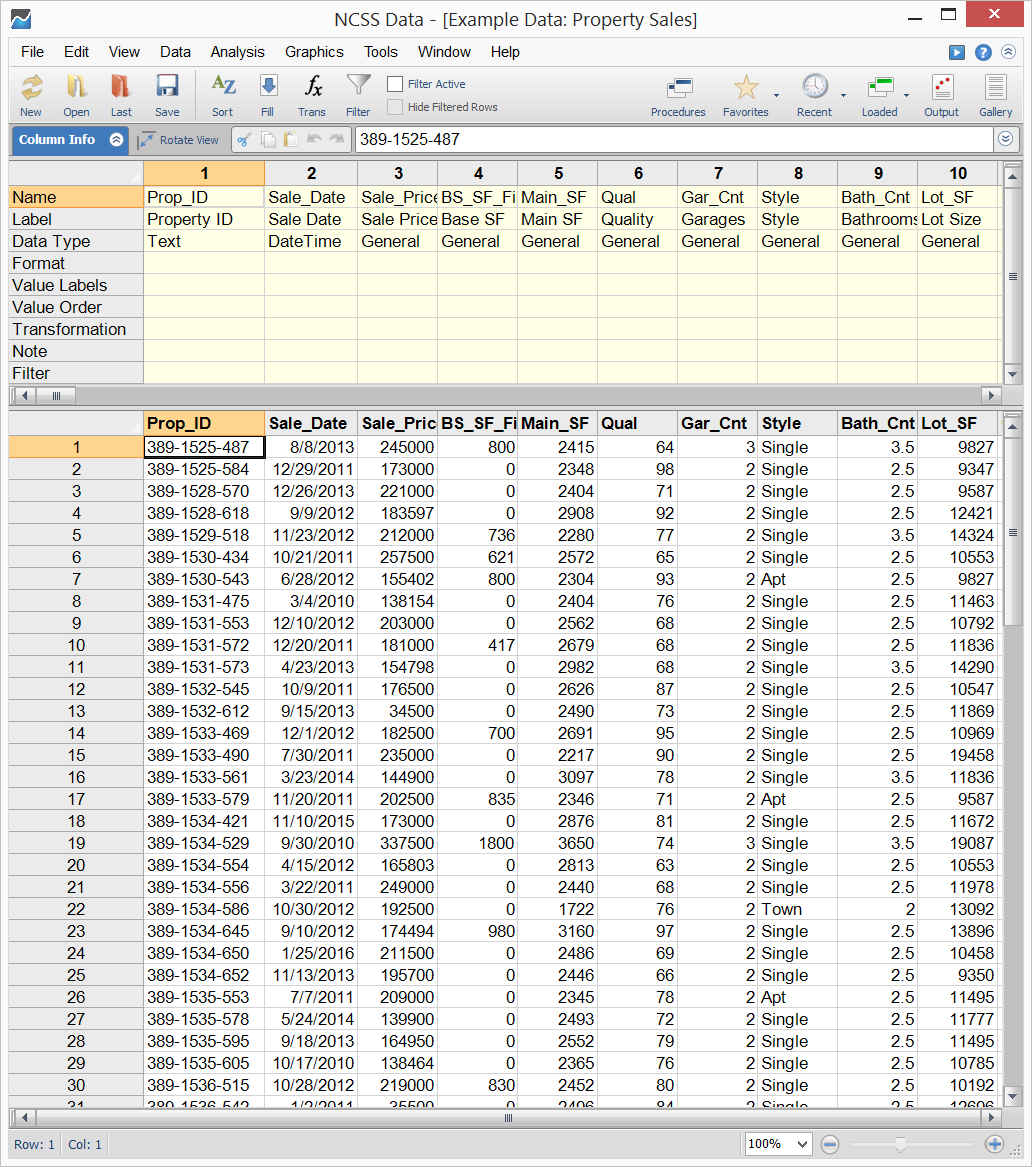

Example Dataset of Sales Price Data

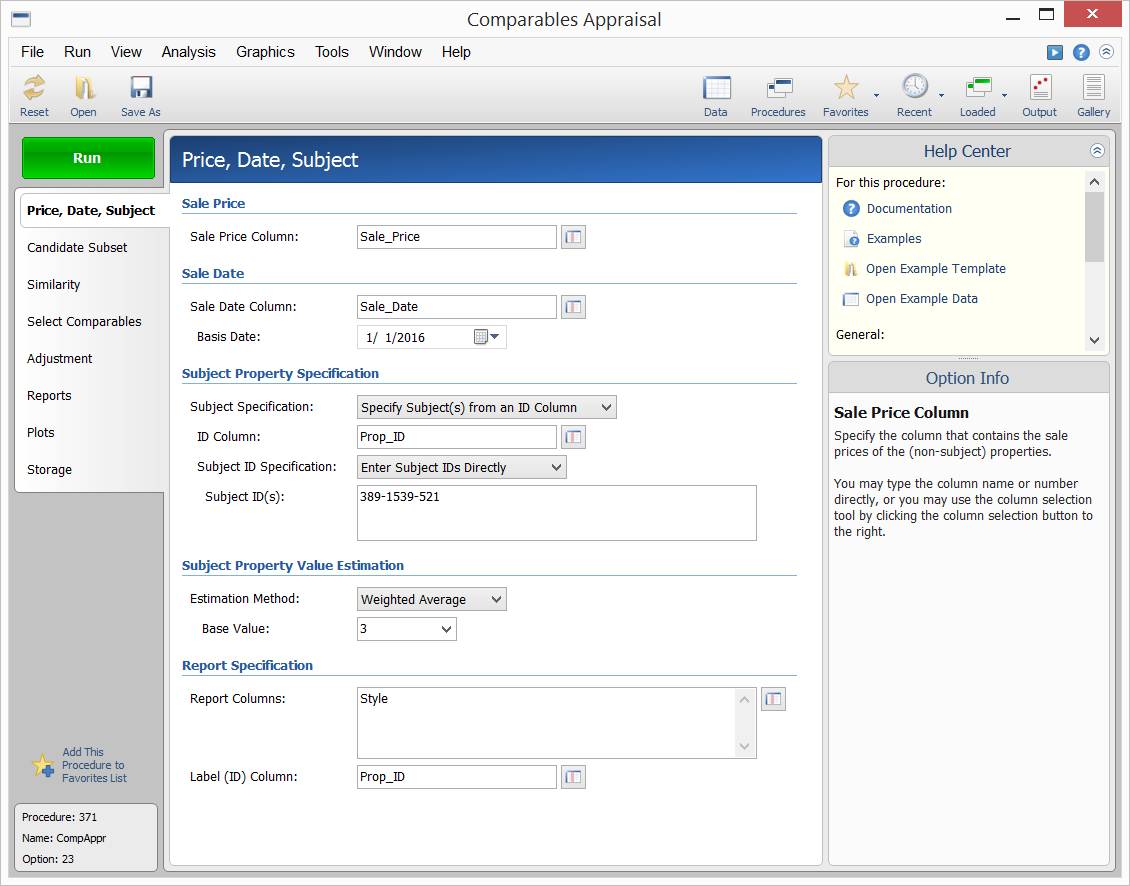

Example Setup of the Comparables Appraisal Procedure

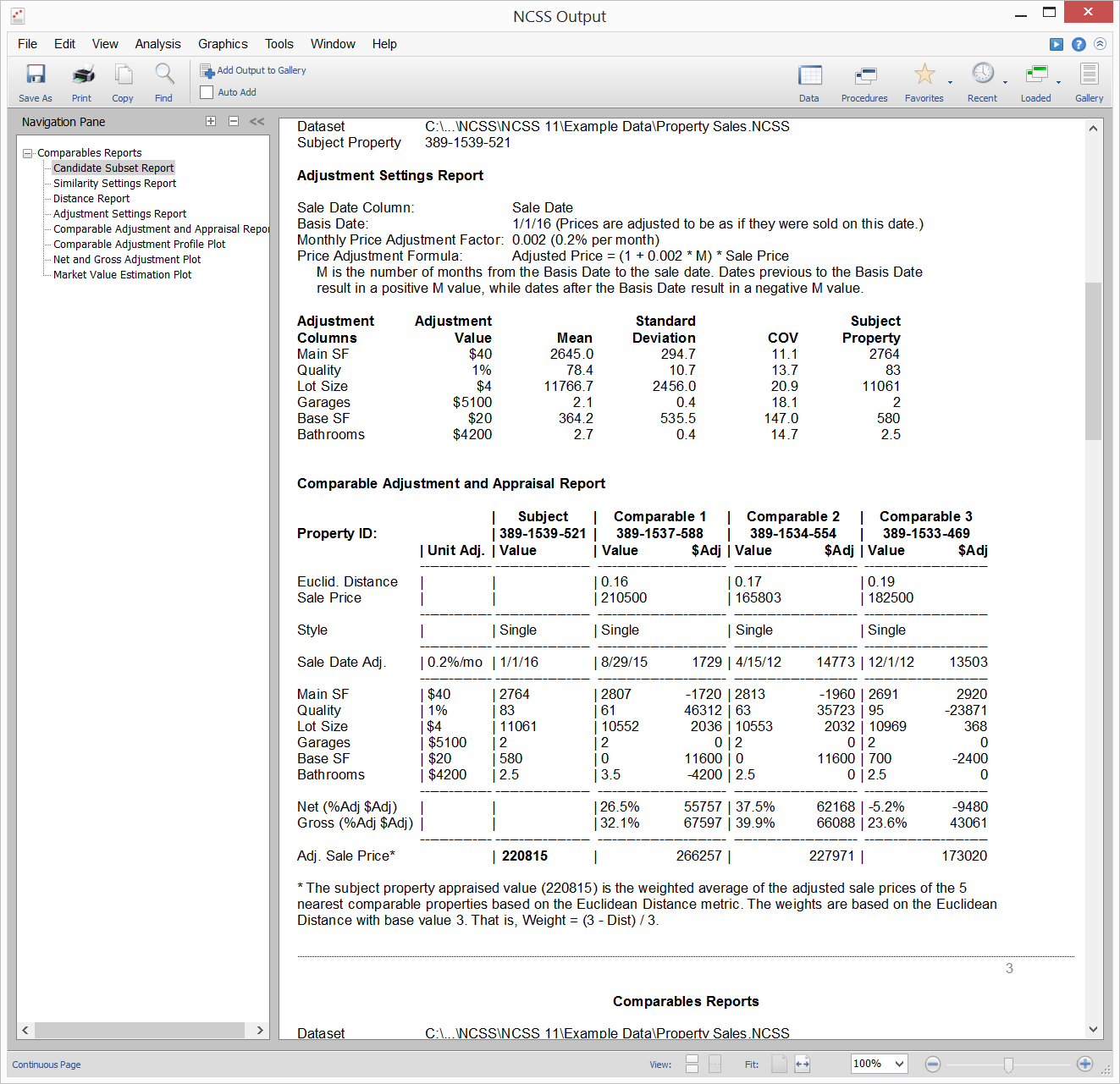

Example Output for the Comparables Appraisal Procedure

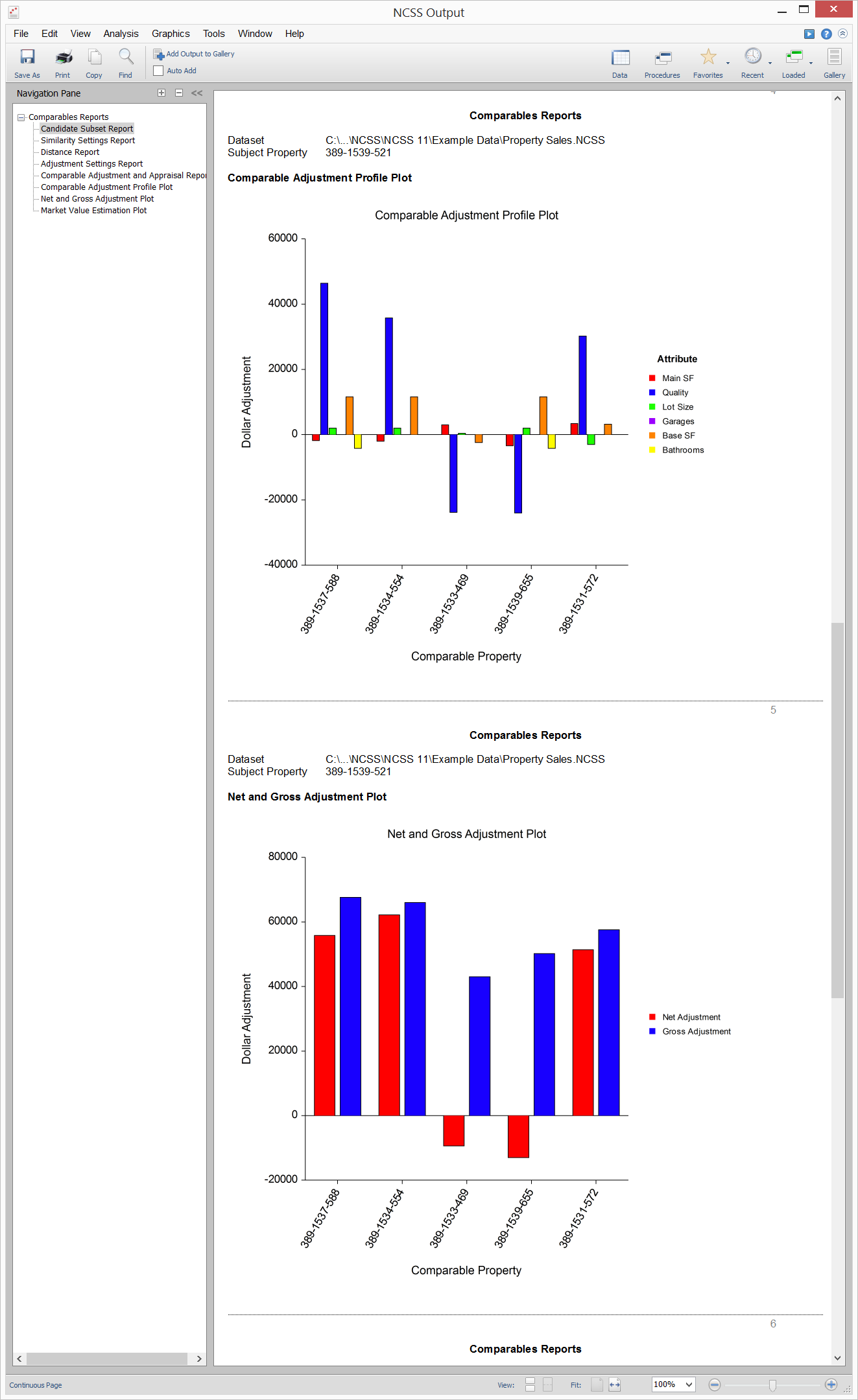

Example Output Graphs for the Comparables Appraisal Procedure

Hybrid Appraisal Models

[Documentation PDF]The Hybrid Appraisal Models procedure is used to estimate the parameters of a hybrid appraisal model, based on the data of a number of properties. This model, with estimated parameters, can then be used to estimate the market value of a single property or a number of properties based on the attributes of each property. Because hybrid models are a combination of additive models and multiplicative models, multiple regression analysis techniques cannot be used to analyze these models. Instead, nonlinear regression methods with differential evolution techniques are used to determine the parameter estimates. The hybrid model is a combination of both additive and multiplicative models. It relates the sale price of properties to various characteristics such as size (in square feet), lot size, construction quality, location, number of bathrooms, etc. Before going straight to the hybrid model, we will begin with the simplest appraisal models and then examine models with increasing complexity until we arrive at the hybrid model. The Hybrid Appraisal Models chapter of the NCSS documentation contains many details about the components of a hybrid appraisal model.

Hybrid Appraisal Models Reports in NCSS

Some of the available reports in this procedure include:- Run Summary Report Section

- Nonlinear Regression Iteration Section

- Differential Evolution Iteration Section

- Model Specification and Estimation Section

- Model (Component Form) Section

- Estimated Model (Reading Form) Report

- Estimated Model (Transformation Form) Report

- Appraisal Ratio Section

- Estimated Values for Estimation Rows Section

- Estimated Values and Residuals Section

- Poorly Estimated Properties Section

Appraisal Ratio Studies

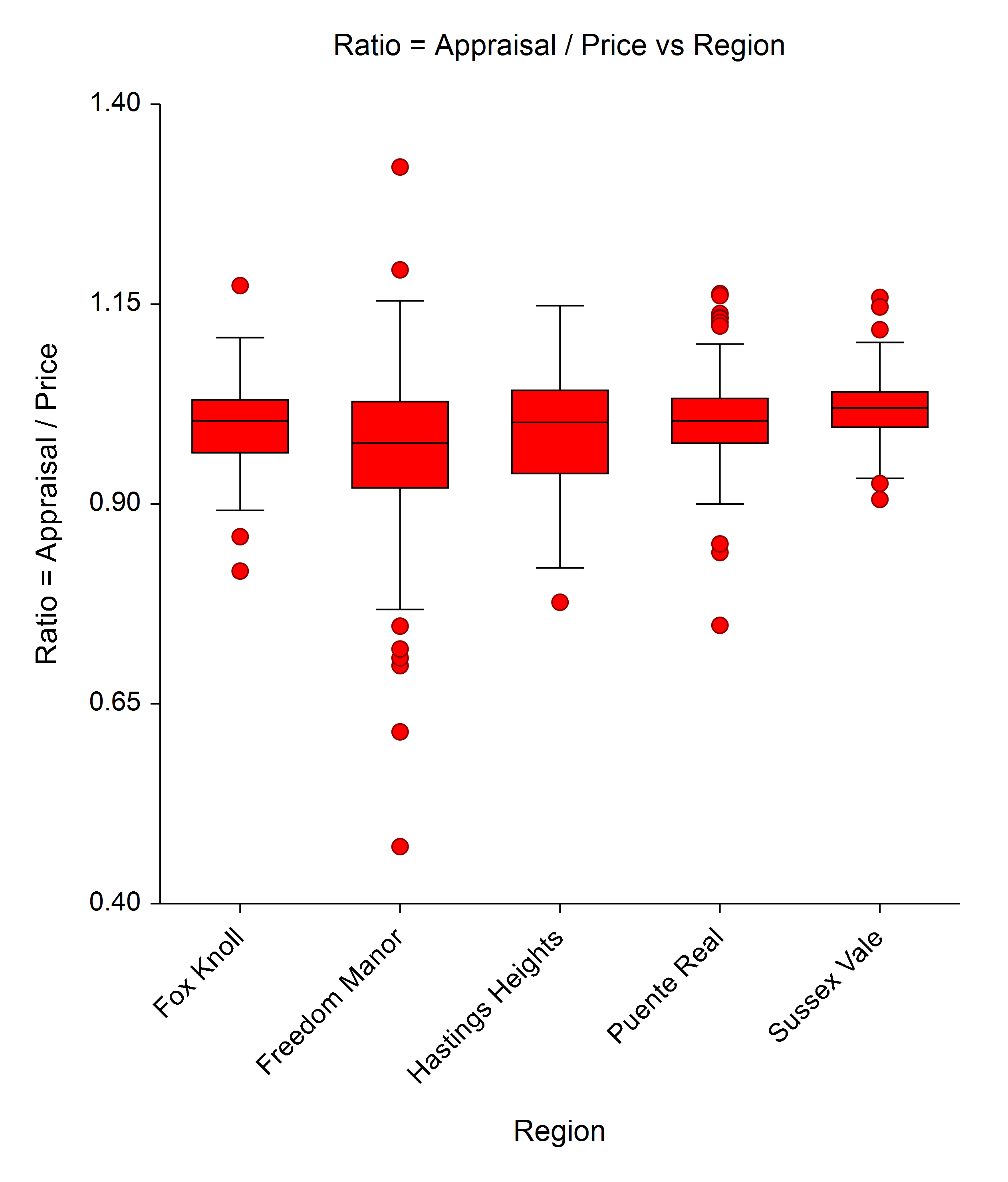

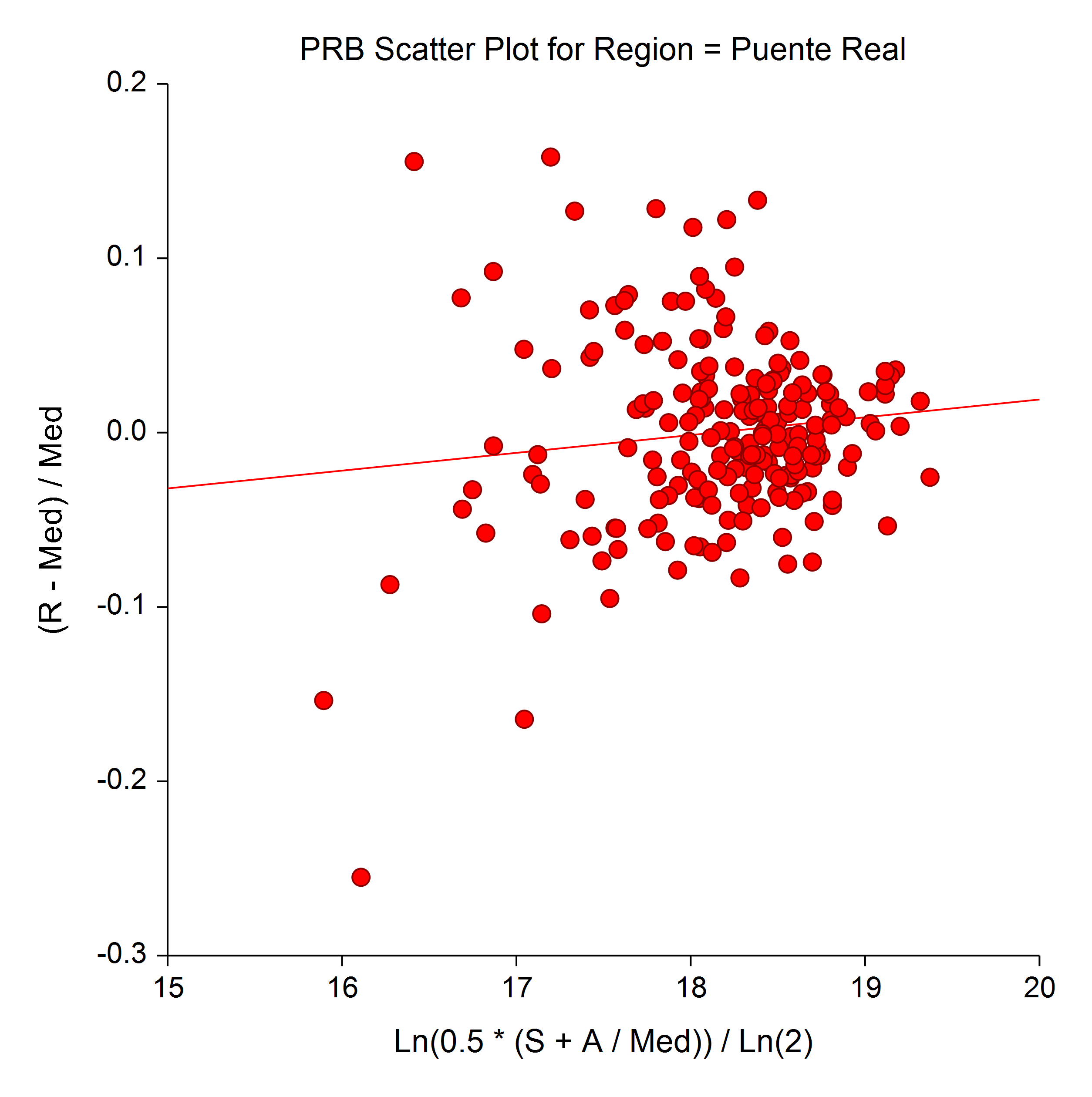

[Documentation PDF]Ratio studies in mass appraisal are regularly used to evaluate the quality and accuracy of appraisal. Ratio studies provide a set of statistics describing the distribution of the ratios (such as central tendency and spread), as well as summaries of uniformity (horizontal and vertical equity). The basic measure in ratio studies is the ratio of the appraised value to the sale price. This procedure provides a variety of statistics to describe the set of ratios under evaluation, including the median, mean, weighted mean, interquartile range (IQR), coefficient of dispersion (COD), coefficient of variation (COV), coefficient of concentration (COC), price-related differential (PRD), and coefficient of price-related bias (PRB), among many others. Confidence intervals are available for the median, mean, weighted mean, and PRB. Normality assumption tests and plots are also included in this procedure. Often there are natural groupings of the appraised values that are compared for equity in appraisal. Examples of such groupings are neighborhood (or market area), property type (or use), size, age, condition, quality rating, and style. Several tools are available in this procedure to evaluate horizontal equity among such groups. These tools include comparative box plots, comparative density plots (and several other distribution comparison plots), assumption tests, and horizontal equity tests such as the Kruskal-Wallis Rank test, the ANOVA F-test, and Welch’s test. Another area of interest in ratio studies is vertical equity (whether ratios are similar across the whole range of appraisal and sale price values). In addition to the PRD and PRB indices of vertical equity, this procedure provides several scatter plots and tests for evaluating ratios across sale price values and appraisal values. Both slope / Pearson correlation and nonparametric Spearman rank tests are available.

- Appraisal Ratio Horizontal Equity Plot

- Appraisal Ratio Price-Related Bias Scatter Plot

Multiple Regression for Appraisal

[Documentation PDF]The Multiple Regression for Appraisal procedure is used to create a multiple regression model relating sale price to one or more property attributes based on a number of properties with known sale prices. Both numeric attributes (e.g., square feet, number of bathrooms, age) and categorical attributes (e.g., neighborhood) may be used in the model. The procedure creates binary (0 or 1) terms for categorical attributes. The estimated model that is produced by running the procedure may be used to estimate the market values of properties for which no sale price is available. The procedure also provides some options for evaluating whether the assumptions of using the model are met. Some of these include Normality tests and plots as well as multicollinearity diagnostics. This procedure can be used to estimate the coefficients of a model with a given form, tailored to property value estimation. If you have a large number of attributes and you wish to have the software sift through and determine the best subset of terms, you may wish to instead use one of the subset selection regression procedures such as All Possible Regressions, Stepwise Regression, or Subset Selection in Multiple Regression. For more complex multiple regression models or diagnostics, you might consider the Multiple Regression procedure or the Hybrid Appraisal Models procedure.

Other NCSS Procedures Useful in Mass Appraisal

Some other NCSS procedures that are very useful in mass appraisal analysis include:- Multiple Regression - Basic

- Multiple Regression

- Multiple Regression with Serial Correlation

- Linear Regression and Correlation

- Nonlinear Regression

- Descriptive Statistics

- Descriptive Statistics - Summary Tables

- Descriptive Statistics - Summary Lists